EOR Interface

The complex made easy

The complexities of placing contractors in the United States is well documented, with different workforce laws at Federal, State and Local levels. The role of an Employer of Record (EoR) is to be your expert in this space.

With our fully integrated EoR contractor management, US funding and back-office solution, we've made the whole end-to-end process simple.

With workforce compliance, payroll funding and time-saving tech we're here to help build your US business securely - with no need to increase head count immediately. It's growth, done the right way.

Workforce compliance

Employer of Record Precision Global Consulting (PGC) the North American division of Workwell Global and Lead & Gain (L&G) are specialists in compliantly processing US Contractors. They have the recruitment knowledge and the state-by-state know-how to reduce any legal risks around your US workforce management and give you peace of mind.

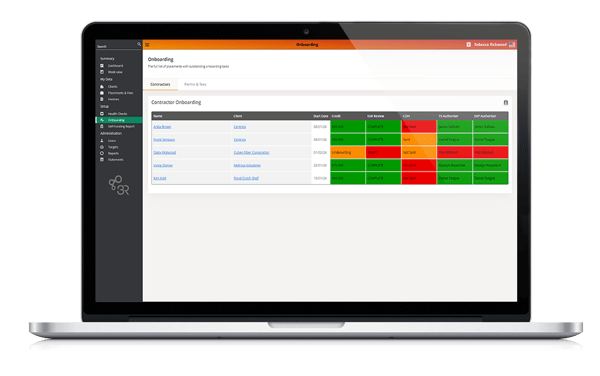

Contractor Onboarding

Worker classification, FLSA and IRS compliance and documentation for W2, Corp 2 Corp, 1099 and Global Remote workers.

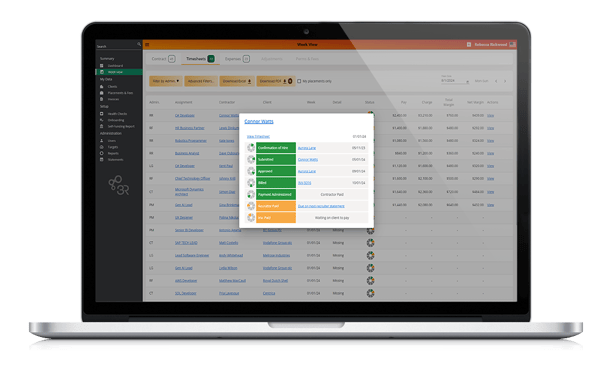

Timesheet Portal

A simple online contractor portal for time and expense entry with fully automated approval management processes.

Weekly Payroll

Insurance, compensation and benefit calculations with accurate weekly payroll and all tax witholdings taken care of.

Expert consultants

Ex-recruiters experienced in US contractor recruitment and compliance specialists ready to help scale your operations.

Employment law

Up-to-date knowledge of legally complex employment laws across all 50 states to tap into including tools and training.

Complex clients

An inter-country team working to seemlessly to overcome the complexities of larger global clients, RPOs and MSPs.

Funding Management

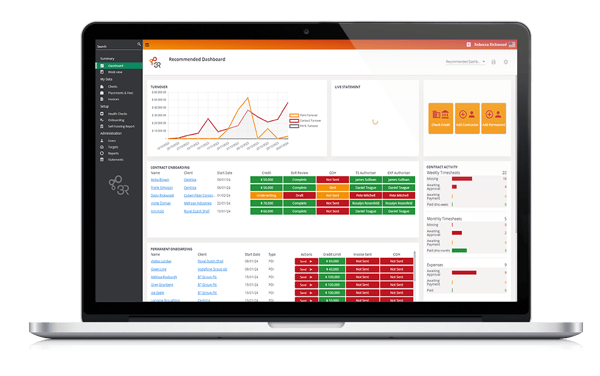

With actionable financial insight from 3R's back-office, you'll find best practice, speed and flexibility built into everything including:

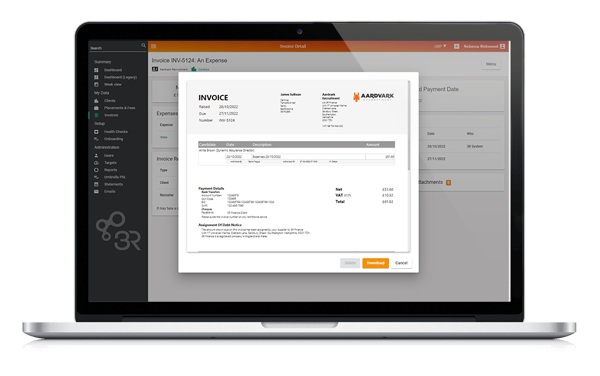

- Dual-branded, automated client invoicing

- Easy purchase order management

- Real-time credit and debt monitoring

- Live funding status tracking and audit trails

- Weekly margin counter and detailed line-by-line statements

It's the same 'easy-to-use' 3R recruiter interface seamlessly integrating with an EoR and customised for US contract recruitment.

A single, time-saving process...

Our EoR integrated platform provides a hassle-free, automated US contractor management solution. It's quick and easy for Recruiters, Contractors and Clients.

-

1Recruiter

1. Credit Check

Get a fast credit check to understand the risk profile of the clients you want to do business with. -

![Automation-icon]() 2EoR / AoR

2EoR / AoR2. Onboard Contractor

Submit your EoR placement for due dilligence checks and to onboard your contractor compliantly. -

3Client

3. Confirm Hire

Send a hire confirmation to your client, allowing them to approve crucial invoicing information with just one click. -

4Contractor

4. Time & Expense Entry

Timesheets and expenses are easily entered on the EoR Portal on the go, anywhere, any time. -

5Client

5. Approvals & Invoicing

Automated reminders encourage quick approvals so invoices can be automatically released for payment. -

![3R_element_whiteout]() 63R

63R6. Funding

With all required information in place, funding is released by 3R to your EoR. -

![Automation-icon]() 7EoR / AoR

7EoR / AoR7. Contractor Paid

Your EoR operates reliable multi-state contractor payroll, including compensation calculations and witholdings. -

![3R_element_whiteout]() 83R

83R8. Recruiter Paid

Every Friday, without fail, recruiter margin is paid including detailed line-by-line statements.

... supported by experts

As a fully outsourced solution, you benefit from responsive in-country experts, ready and waiting to educate, solve challenges and issues and remove barriers to your success.

As service-led organisations joining forces, we have dedicated account managers, risk and compliance, credit control, accounts as well as HR professionals ready to support you.

Recruitment is in our DNA, we're ex-recruiters, we've been there, and we get it! Our unrivalled customer service means you get back time to focus on what matters and build your business. Our integrated EoR Partners are:

US Recruitment Resources

-

The State of U.S. Funding for UK Recruitment Agencies | 3R

Find out more -

U.S. Funding Checklist

Find out more -

US Recruitment Guide: Top industries & states to focus on | 3R

Find out more -

UK Recruiters: Pitfalls to Avoid When Expanding to the US Market | 3R

Find out more -

Handy checklist for Recruiters speaking to U.S. Contractors

Find out more -

Recruit in the United States: List of Cultural Watchouts | 3R

Find out more -

8 reasons UK Recruitment Agencies should expand into the US | 3R

Find out more

Flexible Funding

If you would like to discuss our cost-effective, in-country US contractor funding and how it can help your business scale, please connect with our team.