BACK-OFFICE COMPLIANCE

Get your guide

Back-office compliance is essential for safeguarding your agency's reputation, building trust, and enabling sustainable growth. It reduces legal risks, ensures smooth operations, and supports better relationships with clients and contractors.

Download our guide for essential tools, checklists, and insights to master your responsibilities as a recruitment agency owner or read more below:

Contracts & Terms of Business >>

IR35 & Intermediary Reporting >>

Umbrella Company Compliance >>

Credit Checks & Credit Control >>

Bad Debt Protection & Insurances >>

Contracts & Terms of Business

Overlooking the fine print in contracts can expose recruitment agencies to significant risks, including financial instability and legal disputes. Agencies should thoroughly review agreements from clients, RPO/MSPs and suppliers to understand their obligations and rights.

Regularly updating contracts to comply with current laws is essential for protecting business interests and maintaining strong relationships. Seeking legal advice for complex terms can further safeguard against potential issues.

IR35 RULES

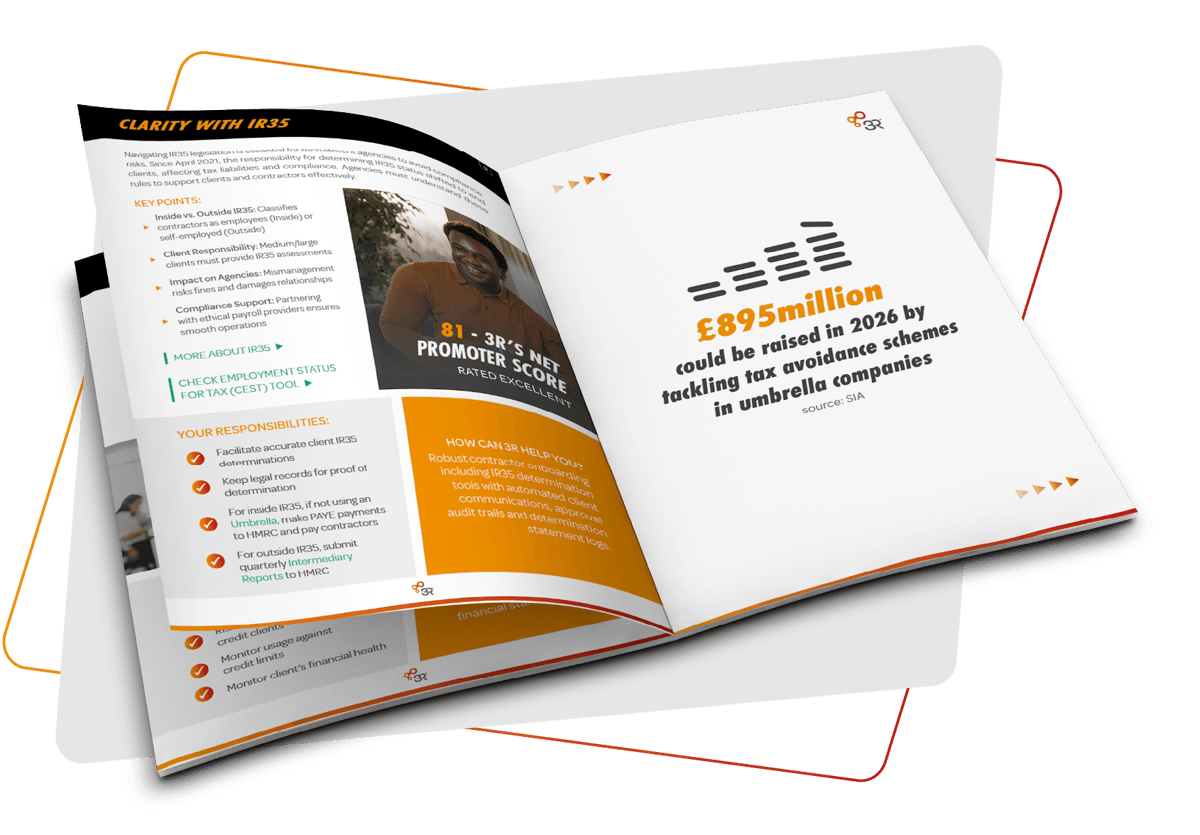

Navigating IR35 legislation is crucial for mitigating compliance risks and effectively supporting your clients and contractors. Understanding inside and outside IR35 classifications is vital, as it determines whether contractors are considered employees (subject to higher tax rates) or self-employed (more tax-efficient).

Since April 2021, the responsibility for determining IR35 status shifted from contractors to end medium & large clients. Those with over 50 employees, over £15m annual turnover or £7.5m balance class as medium & large and have to comply.

For agencies, mismanagement of IR35 status can lead to fines and from the Autumn 2024 Budget it's clear the need for transparency and accountability is only is going to increase.

INtermediary Reporting

Intermediary reporting is an HMRC requirement for agencies arranging for workers to be paid outside of IR35. To avoid costly penalties, you must report contractor IR35 classification reasons and payments information quarterly to prevent tax evasion.

Late or incorrect submissions may incur escalating fines. The HMRC submission template must be used and agencies are responsible for collecting data in a GDPR compliant way as well as storing records and determination evidence securely for at least 3 years.

Umbrella Company Compliance

For contractors inside IR35, umbrella companies act as employers, handling PAYE deductions and ensuring compliance. Over recent years many workers have been failed by umbrellas that failed to comply with their tax obligations - heaping liability and penalties on to contractors, recruiters and end clients.

Currently, there is a renewed focus on workforce supply chains, meaning more transparency and shared responsibility highlighting the importance of selecting compliant umbrella company partners.

With the new JSL reforms, agencies will share accountability and liability for PAYE deductions made by umbrella companies too.

Credit Checks

Assessing a client’s financial stability is vital for recruitment agencies aiming to mitigate financial risks and maintain seamless operations. Conducting credit checks upfront allows agencies to identify potential issues, such as non-payment or payment delays, that could disrupt cash flow and harm business stability.

Credit checks also empower consultants to negotiate better terms, like shorter payment cycles or higher fees. By leveraging these insights, agencies can focus on high-potential clients, enhance financial planning, and make more strategic decisions for long-term success.

Financial Insurances

To sustain smooth cash flow and operational stability, timely and accurate invoicing with proactive credit control is essential to reduce the likelihood of missed payments. Automated reminders and robust aged debt recovery processes can also help agencies stay ahead of financial risks.

In addition, bad debt protection (BDP) acts as a safety net, covering unpaid invoices when clients default or go insolvent. Safeguarding against unforeseen liabilities is highly recommended, it will protect your agency’s financial health, stakeholder relationships and reputation. Some recommended insurances are Public and Employers’ Liability, Professional Indemnity and BDP.

More Resources

-

Tax advice for SME recruitment agencies | 3R

Find out more -

Finance and Back Office Comparison Guide

Find out more -

All about Switching Funding Providers

Find out more -

Recruitment Agency Director Checklist: How to hire your first employee compliantly

Find out more -

Umbrella Company Compliance Checklist

Find out more

Talk to us today

Being ex-recruiters, we're always happy to talk! Get in touch with our experienced team to explore a solution that will meet your needs and surpass your expectations.