Recruitment Funding

Growth made simple

We assess needs and aspirations to offer a flexible, multi-currency, 100% recruitment funding solution for ambitious recruitment agencies and consultancies.

For emerging to established recruitment businesses, we're here to minimise the admin, time, and risk involved in funding. Our focus is on ensuring healthy finances and steady cash flow so you can reinvest with confidence and accelerate growth.

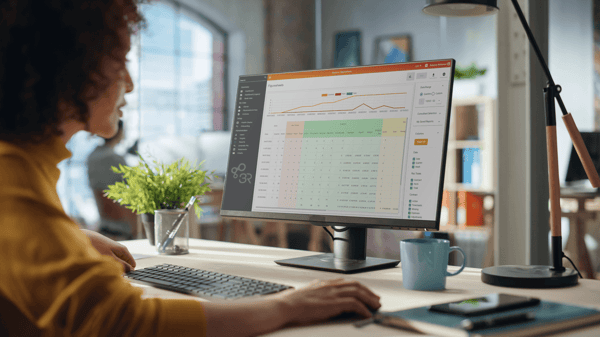

Powered by our easy-to-use back-office platform with support from our expert compliance, accounts and credit control teams, we keep it simple so you can focus on what you do best!

funding solutions

Contractor Funding

U.S. Funding

100% in-country US Dollar funding.

Source a cost-effective and reliable means of growing your contractor base in the United States whilst minimising your expansion risks.

Perm Funding

A total outsourced solution or an ad-hoc facility.

Our flexible funding options mean you can choose to be ‘paid on invoice’ or ‘paid when paid’ and this can be determined on a per-invoice basis.

key features

uncapped funding

The sky is the limit with uncapped UK, EU and U.S. funding that's easy to acquire - no debentures or guarantees.

Fully protected

Includes Bad Debt Protection insurance along with quick, unlimited credit checks for your clients.

Transparent pricing

One clear fee with no surprise charges, penalties, or trading limits. Covers variable interest rates and banking costs.

Margin paid weekly

Reliable & accurate payments. Cash in your bank every Friday without fail. Complete with itemised statements.

Back Office Included

Best-in-class technology included for automated invoicing, effortless financial control, and clear performance reports.

Smart debt control

Our team actively manages client payments, helping to reduce outstanding debt and improve cash flow.

Proven Success

Contract Recruiters joining 3R often see great results that exceed expectations and accelerate their growth.

58%

Contractor Turnover Growth

60%

Increase in Net Fee Income

73%

Increase in Contractor Numbers

Thank you for everything you have done during our transfer. We've had the best service and are absolutely loving the platform. We are so happy to be with 3R and look forward to a long relationship working with you all.

Dan Paine | Co-Founder & Director | W&P Partners

FUNDING & BACK OFFICE COMPARISON GUIDE

Evaluate the best recruitment agency funding options and back office solutions in one place. Download our guide to find the perfect funding for your recruitment agency’s growth.

DownloadFrequently Asked Questions

What are the different funding options for recruitment businesses?

Recruitment Funding is a financial service that provides upfront cash to recruitment agencies so they can pay their contract workers before they receive payment from their clients.

It can be provided by invoice finance companies and commercial/high street banks as well as specialist recruitment funding providers (like 3R). This can be the best option for funding your agency payroll because they don’t just provide cash, they also offer integrated tech and services like automated payroll, timesheet systems, invoicing and credit control.

Recruitment funding is a cash-flow-friendly, invoice-backed solution tailored to recruitment agencies, whereas a standard business loan is a more generic, rigid borrowing method.

Different types of recruitment funding

1. Invoice Discounting / Factoring Enables agencies to unlock working capital by advancing 70–90% of the value of issued invoices. Factoring includes outsourced credit control and client contact. Discounting is confidential, allowing the agency to retain control of collections.

2. Payroll Funding (Recruitment-Specific Finance) A purpose-built solution covering 100% of contractor payroll against issued invoices with integrated back-office support included.

3. Asset-Based Lending (ABL) Provides a flexible credit facility, within a pre-set limit, secured against your business assets - primarily accounts receivable, inventory, or equipment.

4. Line of Credit (Bank or Alternative Lender) A pre-approved loan, giving a flexible credit line that can be drawn upon as required up to a predetermined limit.

5. Private Equity / Investor Funding Capital is provided in exchange for ownership, equity or revenue share in your business.

6. Self-Funding (Bootstrapping) The agency is funded entirely through personal capital or retained earnings, with no external finance or investor support.

How does invoice factoring or payroll funding work for recruiters?

Recruitment invoice factoring gives agencies fast access to cash by unlocking funds tied up in unpaid invoices. It allows you to pay contractors promptly while waiting for client payments.

Payroll funding and invoice factoring are both recruitment finance solutions that release cash against invoices. The key differences lie in how they support your operations:

- Invoice factoring is a more general funding method. It typically advances 70–90% of the invoice value upfront, with the balance paid once the client settles the invoice.

- Payroll funding, on the other hand, is purpose-built for recruitment agencies. It ensures 100% of the invoice value is covered and aligns with your payroll schedule, so contractors are paid on time - every time.

How Recruitment Payroll Funding Works:

- Your contractor completes their assignment and submits timesheets.

- An invoice is raised to the client (typically with 30–90 day terms).

- The funder pays your contractors directly.

- You receive your margin upfront (invoice value minus payroll and fees).

- The funder manages collections from your client.

At 3R, we fund 100% of the invoice value and offer daily payments to ensure UK and EU contractors are paid within 24 hours of an approved timesheet, and weekly in the US. Recruiters receive their margin every Friday without fail. Our solution also includes integrated back-office tech and outsourced credit control to streamline your operations.

What do I need to qualify for recruitment funding?

The specific requirements for recruitment funding vary by provider, but most will ask for:

- Proof of legitimacy – Company registration, identity verification, and business bank account details

- Trading history or business profile – Information on your clients, invoice values, and the split between perm and contract placements

- Credit risk assessment – Some funders will run credit checks to evaluate the risk level of your business and your clients

If your business is considered high-risk, some funders may ask for additional security (such as a personal guarantee or debenture) as protection in case of non-payment. In some cases, these are required regardless of your business profile.

How 3R makes it easier

At 3R, we keep things simple and flexible. We do not require personal guarantees or debentures as standard, making our funding a lower-risk option for growing agencies.

When comparing providers, it’s important to ask about security requirements upfront, so you understand your exposure and obligations.

Ready to explore recruitment funding? Just reach out for an initial conversation and demo. The right solution depends on your current business stage, growth plans, and appetite for risk and we’re here to help you navigate that.

Book a demoHow is recruitment funding normally priced?

Recruitment funding is typically charged as a percentage fee on each invoice. For example, if your provider charges 2.5%, you'll pay that amount on every invoice processed.

Fees vary between providers and can depend on:

- Your business’s risk profile

- The services bundled into the fee (e.g. tech platforms, compliance support, credit control, insurance, and access to experts)

- The payment terms you agree with your client and /or contractors can affect pricing with some providers

What’s most important is to compare like-for-like. The cheapest rate might not offer the best value if it excludes essential services or lacks service quality. Read more about how to get the right deal.

3R’s Transparent Pricing

At 3R, our funding is pay-as-you-go. We only earn when you do. There are no other monthly costs to consider, no hidden extras. We simply charge one fixed fee on the lower .Net invoice value. Many providers add on platform costs, service fees and late charges.

How do I choose the right funding provider or product?

Ask the right questions, do your due diligence, and compare providers carefully - every detail matters. The right partner can help grow your business.

Key things to consider:

- Funding percentages: Typically, 60–100% of invoice value

- Hidden fees: For setup, admin, transfers, renewal, or other penalties

- Contract specifics: Lock-ins, exit fees, personal guarantees, turnover or concentration limits

- Operational cadence: Timesheet deadlines, payroll timings, invoicing runs and margin payments

- Added value: Credit checks, bad debt protection, back-office tech, reporting tools, multi-currency support and outsourced credit control

- Service levels: Responsive teams, dedicated account managers, recruitment expertise

To get the best back-office funding solution for your recruitment agency use 3R’s comparison guide – it includes a detailed checklist, key questions to ask, and supplier evaluation templates to help you choose with confidence.

DOWNLOAD GUIDEWhat type of contractor payroll and currencies are available?

The types of contractor payroll and currencies available vary by funding provider. Some providers focus on specific regions or payroll models, offering deep expertise in their area. In many cases, it's better to choose a specialist that meets your needs now and as you grow to ensure compliance, speed, and service quality.

At 3R we specifically support with:

- UK, EU and US funding

- Funding for contract, permanent and consultancy placements

- UK Ltd company payroll processing

- UK & international umbrella company payments

- US payroll support across W2, Corp to Corp, 1099 and global remote workers

We also offer a discretionary PAYE facility on a case-by-case basis. Currently, we do not support CIS (Construction Industry Scheme), unless through an appropriate umbrella company.

How do contractors get paid with recruitment funding?

With recruitment funding, contractors are typically paid directly by the funding provider, rather than the agency. The provider advances the funds and then recoups the payment from the agency once the end client settles the invoice.

One of the most important factors is payroll frequency. Timely, consistent payments help keep contractors happy and protect your agency’s reputation. While weekly payroll is often seen as the industry standard, more frequent pay cycles can be a major advantage.

How 3R pay contractors

UK & EU - We run daily weekday payroll, meaning contractors are paid within 2 working days of a timesheet being approved. Payments are made directly to either Ltd Company bank accounts or to Umbrella Companies who will pay the contractor

United States - In the US, we provide daily weekday funding to your chosen Employer of Record (EOR). This enables your EOR to run reliable weekly payroll for W2, 1099, or Corp-to-Corp contractors.

What are the benefits of Bad Debt Protection (BDP) in recruitment funding?

BDP insurance protects your agency if a client can’t pay – normally covering up to 90% of the invoice value. It adds peace of mind, ensuring you’re paid for services delivered.

To reduce risk, agencies should support timely client payments through:

- Regular credit checks

- Clear contracts and terms

- Accurate invoicing and reminders

- Effective PO and debt management

Read more about why BDP is vital for recruiters.

At 3R, we’ve built these safeguards into our processes from the start - through diligent credit checks, 'Confirmation of Hire' approvals, invoice accuracy, and proactive credit control. Non-payments are rare, but should a client go into administration , BDP is included as standard with our funding, giving you added security.

What can I do if a client has low or zero credit?

Clients with low or no credit carry a higher risk of non-payment, but that doesn’t mean they’re not worth working with. Sometimes, it’s still valuable business. Funded start-ups, for example, may show no credit simply because they haven’t filed accounts yet.

The best approach is to make sure your decisions to work with clients are well informed. Some simply just can’t get credit - and anyone who says otherwise probably isn’t being honest.

Ways to reduce risk:

- Negotiate shorter payment terms to stay within low credit limits

- Offset risk by adjusting your fees

- Request upfront or milestone payments instead of credit

At 3R, our compliance team reviews client credit limits upfront, using top-tier credit score platforms and insurance partners. We help you make informed decisions and explore workable solutions openly, honestly, and early - so you can take on valuable opportunities while managing risk.

More About Credit ChecksWhat are the benefits of outsourcing credit control as part of recruitment funding?

Outsourcing credit control allows recruitment agencies to free up time and resources, focusing instead on business growth and client relationships. It brings in experienced professionals with the tools and skills to manage credit efficiently, keep cash flowing, and reduce debtor days - without the cost or effort of hiring and training in-house staff. A strong credit control function also protects financial health and ensures operations run smoothly.

Read More about the true value of outsourcing back office operations.

At 3R, credit control is built into our funding solution. Our dedicated team monitors payments daily, sends automated reminders, and supports you in reducing debtor days - while keeping you fully informed. You’ll have visibility of outstanding payments, and if needed, we can escalate to legal proceedings. We work as your finance partner in a collaborative and flexible way, we’re an extension of your team.

What back office tech do I need to manage my recruitment funding?

To manage recruitment funding effectively, you need a secure, purpose-built back office platform designed specifically for recruitment agencies. A robust solution should help you maintain healthy cash flow, reduce risk, and streamline critical operations - such as timesheets, invoicing, payroll, and credit control.

The best recruitment back office software integrates real-time financial data, full audit trails, and tools tailored to the recruitment lifecycle - from onboarding to payment. It should handle credit checks, manage credit limits, automate payment reminders, and offer accurate, compliant reporting.

Read More about the back office software your agency needs.

3R’s back office solution delivers all this - and more. Our platform supports your entire contractor workflow, from online timesheets to weekly payroll and invoicing, all backed by a responsive support team. You’ll also benefit from built-in credit control, remittance management, and real-time insights to keep your business running smoothly and securely as you scale.

What is included in 3R’s funding solution?

3R’s all-in-one recruitment funding solution is designed to support both your cash flow and operational efficiency.

We fund payroll daily for all your contract assignments, with optional perm funding available as needed. Funding is secured with free, unlimited client credit checks and Bad Debt Protection (BDP) to safeguard against non-payment.

You also get unlimited access to our Back Office platform, packed with smart tools to streamline contractor, client and financial operations:

Client Management

- Digital contract storage

- Online Confirmations of Hire (COH) and timesheet approvals via Client Portal

- Invoicing & PO management

Contractor Management

- Contractor onboarding workflows

- Employer of Record (EOR) integration (US)

- IR35 determination & intermediary reporting (UK)

- Contractor Portal for:

- Time & expense submission on the go

- Access to remittances and payment details

Financial Management

- Weekly recruiter margin payments

- Detailed and easy to administer financial statement

- Reporting Suite – compliance, finance and performance reports

- Accounting integrations and support

Alongside funding and tech, you’ll have access to an expert team acting as an extension of your business, including:

- A dedicated Account Manager

- Credit Control Manager

- Risk & Compliance oversight

- 24/7 Help Zone access

- Business consultancy from experienced recruitment professionals

Plus: Access to our partner network, exclusive offers, and integrations with leading RecTech platforms.

There’s more to explore. Why not request a demo and see it in action?

BOOK DEMOHow do I transfer from my current funding provider?

Start by reviewing your contract to understand exit terms - notice periods, timeframes, and any potential exit fees. Knowing these details upfront helps you plan the transition with confidence.

Once you're ready, engage your new provider to manage the switch.

At 3R, we make this process smooth and stress-free. Our expert transfer team follows established IF/ABL guidelines to audit your ledger, solve issues transparently and agree a date to buy out any existing debt. We work positively with your current provider and guide you through every step from stakeholder comms and contractor onboarding to data entry and system training. With a dedicated point of contact and regular check-ins, we keep things moving and ensure a seamless transfer for you, your clients, and your contractors.

Migrate your contractors to 3R

Our expert transfer team will work closely with you, following Invoice Finance and Asset Based Lending (IF/ABL) guidelines to audit your ledger and transfer your contractors. We'll train you and your team on the back-office platform to ensure a positive experience for all involved.

Talk to us today

Being ex-recruiters, we're always happy to talk! Get in touch with our experienced team to explore a solution that will meet your needs and surpass your expectations.