The importance of client credit checks for recruitment agencies

A credit check is a quick look at the financial history and status of the clients you are going to be doing business with. Whilst some of this information is available in the public domain, there are paid for specialist credit reference bureaus that hold extra information on the risk profiles and available credit limits for your clients.

Performing credit checks ultimately helps you manage risk around non-payment, yet savvy recruitment agencies can leverage the credit check in other ways, to really drive their agency in the right direction.

This post goes into more detail about how credit checks can help you grow your agency.

Why are credit checks important?

When should you run your checks?

How to handle low client credit scores?

How can you use credit checks to help grow your business?

Why are credit checks important?

Firstly, as mentioned above, understanding the credit status of a client and what the potential risk may be before you start dealing with them is a vital step in the process. As you will be paying contractors before you get anything back from the client, any delay or non-payment could see you suffer a significant loss.

Decisions won’t be made in isolation from just credit check information; however, it is a valuable aspect in deciding early on if you want to work with the company at all.

When should you run your checks?

Timing is everything when it comes to credit checks. The best time to run such checks is when you first pick up a vacancy from a potential client. Otherwise, you run the risk of hitting the following issues:

- Ask too early - If you are checking out a company before you are even talking to them, then that will be of little use to you. It may be months before you convert them into a business opportunity - if at all – and during that period, anything can change.

- Ask too late - In contrast, you don’t want to end up in a situation where you have a contractor starting the same day and only then find out that the client is a high credit risk. This could leave you in an embarrassing situation where you need to renegotiate terms, or worse still, back out of the deal completely.

How to handle low client credit scores?

Credit checks, done at the right time can help your business build robust and appropriate contracts. With risk profiles and credit limits known, you give your consultants the confidence to negotiate fees and payment terms that reduce risk.

For example:

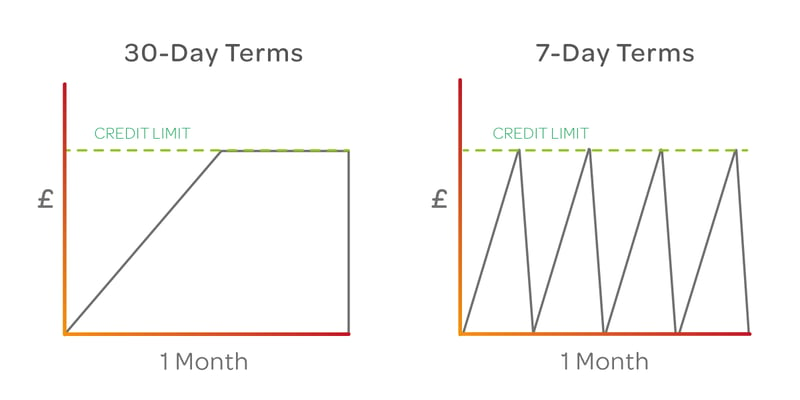

- Negotiate shorter payment terms to make the most of smaller credit limits

Shorter payment terms at 7 days or 14 days, means a quicker cycle of payments received that gets you more flexibility from the same credit limit within a month

- Suggest higher fees to offset the risk you are taking

Being transparent about your concerns with your clients can make taking the risk more worthwhile and goes a long way towards building the best relationship going forward.

- Suggest payment options that don’t require credit

You can suggest working on a fee-based basis, leveraging part or full up-front payments. For permanent recruitment, ‘Paid when Paid’ options from finance providers also give you flexibility.

Partnering with the right recruitment factoring/finance service will also keep you insured against any bad debt, save you the hassle of chasing clients for invoice payments and keep your business on top of aged debtors.

Best practice from pro-active suppliers means they will also be freely available to talk to you directly about any credit issues you foresee, and will work with you to find the best solutions.

How can you use credit checks to help grow your business?

In addition to helping manage financial risk in your agency and negotiate the right contractual terms for clients, efficient credit checks done in a timely way can:

- Support your team to achieve faster, de-risked placements

- Give you foresight into the volume of contractors you can place with each client for improved forecasting & business planning

- Support prioritisation of clients, so you can focus on those that have more potential for growth

- Give your team the confidence to lead with effort versus reward decision-making

- Retain a competitive edge, by reducing the risk of contractors not being paid on time and having a bad experience

Credit checks with 3R

At 3R we’re different, we offer upfront, unlimited and free credit reports to all our clients. They are turned around within the same day and if you need one immediately, you can also phone your Account Manager for help.

Our back-office system keeps you in the loop instantly with automated email notifications about credit check outcomes. And, to support our clients to get the most value from 3R credit checks, we have recently released a 5 Star credit potential rating and client assessment.

5 Star

This gives you an instant trading limit as well as an indication of the headroom and potential for growth with credit-worthy clients. For those clients with no credit available, as recruitment experts, we fully advise on the alternative options open to you and are always available on the phone for a chat about specific cases.

To find our more about credit checks with 3R or to get a demo of our back-office system, please give us a call on 01489 854 741 .

Last updated: September 2024